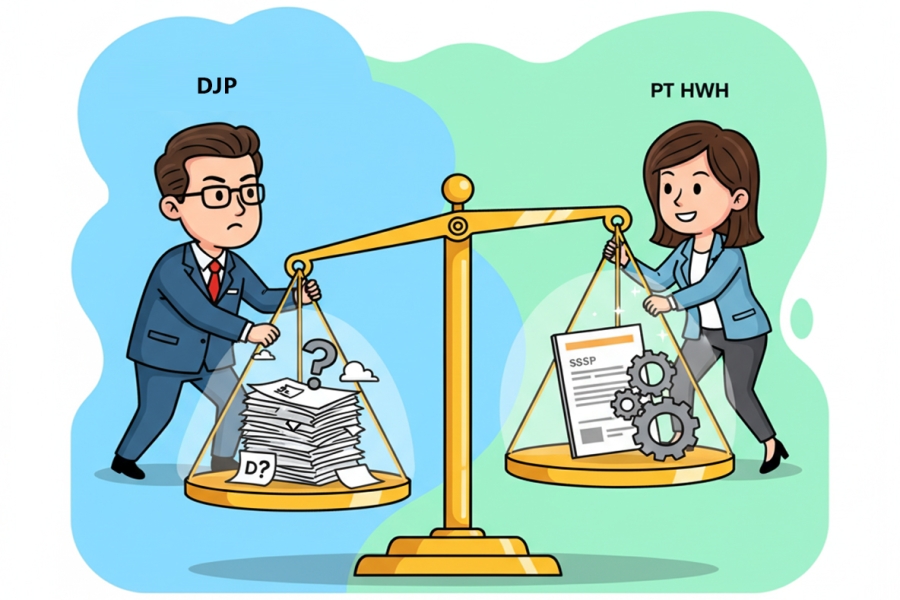

Value Added Tax (VAT) Input Tax disputes often become an arena of conflict between formal compliance and substantive proof. The case of PT HWH highlights the complexities of crediting VAT arising from the Utilization of Taxable Services from Outside the Customs Area (PPN JLN).

The Directorate General of Taxes (DJP) issued a correction on the Input VAT stemming from the self-payment of PPN JLN by PT HWH. The DJP argued that this PPN JLN was ineligible for crediting due to various reasons, ranging from doubt over the economic benefit of the service (the benefit test) to imperfection in the formalities of the tax deposit.

PT HWH firmly maintained its right to credit the PPN JLN. The VAT had been deposited using a valid and timely Tax Payment Slip (SSP), thereby fulfilling the formal requirement for crediting PPN JLN. Substantively, PT HWH presented documentary evidence, including contracts, invoices from the foreign party, and internal reports, which proved that the service actually existed and was directly beneficial to the company's operations that generated Output VAT.

The Panel of Judges conducted a deep review of the SSP documents, PPN JLN payment evidence, and the Taxpayer's functional analysis. The Panel ruled that as long as PT HWH could present valid proof of PPN JLN payment and demonstrate that the utilized service had a direct correlation with the business activities, the right to credit could not be annulled merely based on the DJP's doubts.

In this decision, which resulted in a Partially Granted ruling, the Panel granted the cancellation of the Input VAT PPN JLN correction that PT HWH successfully substantiated. This decision reinforces the jurisprudence that the valid formality of PPN JLN payment (SSP), coupled with proof of the service's substantive benefit, is key to defending the right to credit Input VAT.

Comprehensive and Complete Analysis of This Dispute is Available Here